Secured vs. Unsecured Financing: What Small Business Owners Should Know

Never needing to borrow money and paying everything in cash is the dream, right? No interest rates, no processing fees, no lengthy applications, and no credit checks. Unfortunately, that’s not very realistic for many people, particularly those operating a small business where the costs often require some form of financing.

The good news is, you don’t need to make it onto Shark Tank and strike a deal with Mr. Wonderful before you can start, or expand, your business. There are plenty of financing options on the table that don’t require a sales pitch on national television.

Financing comes in two forms: secured and unsecured. There are pros and cons to each, and before entering into any loan agreement, you should be well aware of the benefits and risks to make the best financial decision for your situation.

First things first: Secured vs. Unsecured

Secured loans require collateral. Unsecured loans do not.

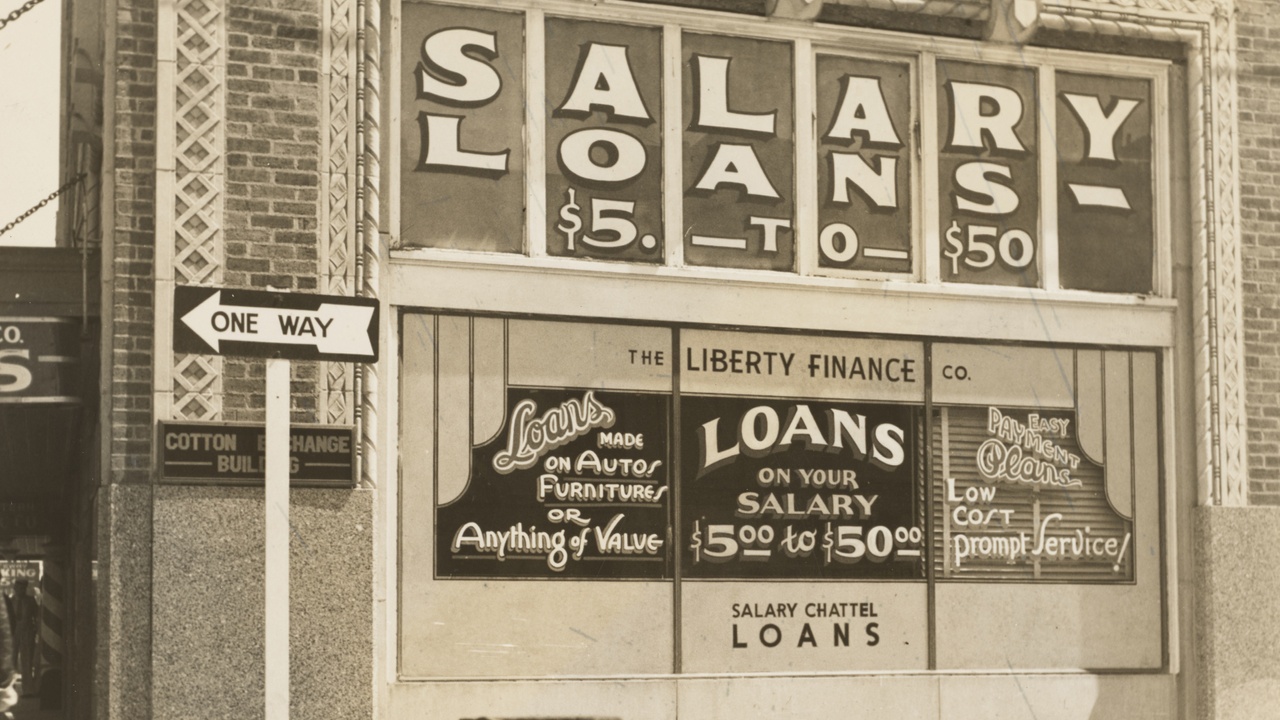

Mortgages, car loans, and pawnshop loans are all examples of secured loans. In exchange for the funds, the lender will hold the deed to the physical property or asset that has been financed until the loan has been satisfied.

When working with unsecured loans, there is no collateral involved. The loan is made based on your creditworthiness and given in good faith that you will pay the loan back in full. Credit cards, student loans, and personal loans are all considered unsecured.

A closer look at Secured Loans:

- Pros: Secured loans are less risky for lenders and more accessible for borrowers to qualify for. They also often come with lower interest rates and the option to make smaller payments over an extended period of time.

- Cons: Secured loans can mean a lot of paperwork. Anyone who has purchased a building or car understands the time-consuming application for funding. If you default on your payments, the lender will seize your collateral (which means kissing goodbye your valuable business assets). And there are also more rules and regulations around what you can use the money for.

A closer look at Unsecured Loans:

- Pros: Unsecured loans don’t require you to leverage any assets, so if you default on payments, you aren’t at risk of losing whatever it is you financed in the first place. And because the lender isn’t analyzing collateral value, the financing process can be much quicker than its secured counterpart.

- Cons: With an unsecured loan, it may be harder to get approval because there’s no safety net for the lender in terms of collateral. And without a good credit score, you’ll have a hard time qualifying for lower interest rates.

Which one is the right one for your small business?

There are many factors to consider when making this decision, including how much money you need to finance, for what purpose, and how long your business has been operating.

- Are you a new business? You may face a more challenging uphill battle trying to qualify for unsecured loans. There’s no collateral attached, so lenders will be extra scrupulous in examining every inch of your credit score and financial history.

- Are you an established business? If you have annual earnings of at least six figures and have been operating for at least two years, you may qualify for an unsecured loan based on these merits.

- How much money do you need? Unsecured loans are normally available in increments between $1,000 - $50,000 (though $100,000 loans aren’t completely unattainable).

- If you want to finance smaller projects, an unsecured loan may be a great choice because your physical assets aren’t directly tied to the loan itself. However, borrowers beware of “Blanket Liens,” which means a “lender can lay claim to any or all of your small business assets if you default on your loan.”

- If you need to finance a large amount, pursuing a secured loan will probably be necessary. And yes, you do essentially “risk” your business’s collateral; however, you’ll have a lower interest rate, have longer to pay it off, and are more likely to qualify for the funding.

It goes without saying that regardless of which option you choose, you should enter into any form of financial agreement with all the facts. Only borrow what you are confident you can repay, and do what makes the most sense for your own personal situation.