No Jacket Required

Pivot: /ˈpivət/ /ˈpɪvət/ to turn or rotate like a hinge or a successful business owner.

During a recent episode of our Podcast, The Liquid Lunch Project, my partner Matthew Meehan and I addressed the need for a business to be agile and its ability to effectively Pivot when the needs arise.

This is the tale of one of the greatest Pivots of all time.

In 1967, five students from Charterhouse, a boarding school in Surrey, England formed a rock band that would go on to transform the style of rock. Imagine a graduating class including Tony Banks, Mike Rutherford, Phil Collins, Peter Gabriel, and Steve Hackett! Incorporating innovative themes and nontraditional instruments, Genesis went on to becoming one of the most sold and highly decorated bands of all time.

From 1970 to 1975, Collins played drums and percussion for the Band.

In August 1975, following The Lamb Dies Down on Broadway tour, Gabriel left Genesis. The band placed an advert for a replacement in Melody Maker and received ar...

Alloy Allies

Consultants as Catalytic Converters

There is often confusion as to the role of a consulting firm within the parameters of a small business. Pop culture is replete with tales of the swashbuckling, chart carrying MBA graduate seeking to revolutionize the world via the use of pie charts and tedious board meetings. In realty, a strategic partner can take the American small business to the next level. Albeit with the full cooperation of ownership.

Analogies are often the most effective manner to convey a point. Allow me to take you back to high school physics class. Remember our friend, the alloy? An alloy is a substance created from the combining of two or more elements. The classic 1+1=3. The mechanical properties of alloys will often be quite different from those of its individual constituents. You see where I am going here… American small business, often family-owned, with a proud type- A founder resistant to any change may be wary of such transformative catalysts. After all, “I have ...

Go Bold or Get Old

The American Entrepreneur is Not Easily Deterred

One of our organization’s mantras, if not obsession, is our desire to implement systems within our client’s operations to allow for streamlined operations. A beautiful thing occurs when an entrepreneur is not bogged down by administrative muck: he or she is able to dream. When an American small business owner dreams, special things happen. Expansion plans, acquisitions, diversification of product lines: a business owner must have the peace of mind to think in bold macro terms.

This is part of the American historical mindset. Some of the greatest transformative acts in our history came with much resistance. Let us look at several bold, transformative decisions and that decision maker’s ambivalence towards the vehement opposition resulting therefrom.

Acquisition of The Louisiana Territory was a long-term goal of President Thomas Jefferson. Seeking control of the vital Mississippi River port of New Orleans, Jefferson tasked Jimmy Monroe ...

Experts Exit Stage Left

How Expertise Has Recently Changed Significance

Traditionally, expertise, was an accolade reserved for someone who spent years honing his or her craft to such a degree they were considered an authority. Experts engage within a given subject matter from various perspectives developing their knowledge over time, through a combination of research and experience. That nurturing of a specific skillset takes time to develop. A lot of time. During that time, that future expert is known by his or her peers cultivating a reputation that positively deviates from the norm. By the time one is referred to as an expert, it is not disputable. Gretzky was an expert hockey player not at 17 but at 27..

Achieving a high level of fidelity in one’s craft may take countless paths. Regardless of how simple or complex the activity being practiced; the brain undergoes subtle yet significant changes as your skill mastery develops. To practice a skill, you first learn the basics of how it works. It may feel u...

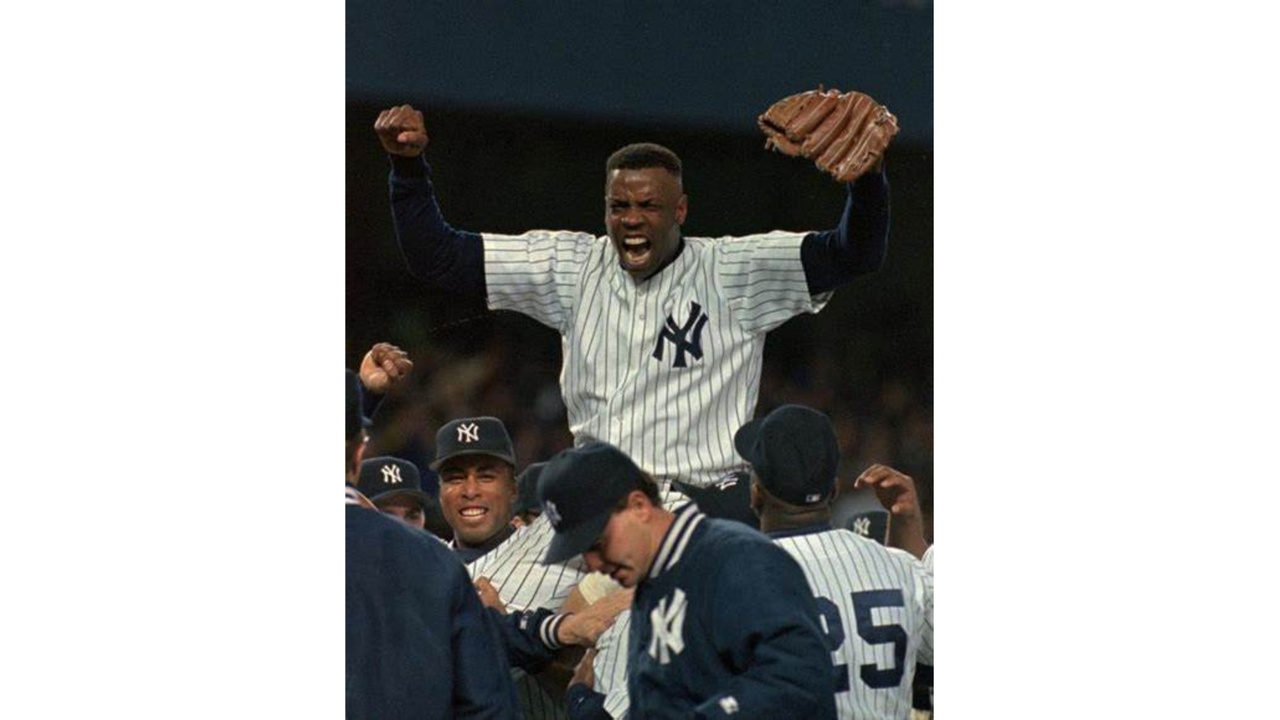

SAG Ace of the Rotation on Clubhouse

Shield Advisory Group had the privilege of hosting a Clubhouse Room last night with a special guest appearance by baseball icon Dwight “Dr K” Gooden.

As a 3X World Series Champion, Cy Young Award Winner, Rookie of The Year and 4X All Star, Dr K shared his experiences about the tools needed for winning. At the highest levels. We learned these tools were transferable to other facets of life. From Dr. K’s warm recollections of his childhood under his father’s mentorship and tutelage to his time amidst the media spotlight and fanfare we were given a brilliant display of humanity.

It was soon evident Doc was not only physically gifted as an athlete, but he was also usually the hardest working guy on the training grounds.

Doc shared insights into the discipline and work ethic necessary to take any career to the highest levels. Moreover, he regaled us in tales of the teen phenom transitioning into a league competing against the best players in the world.

We also learned about the contrast...

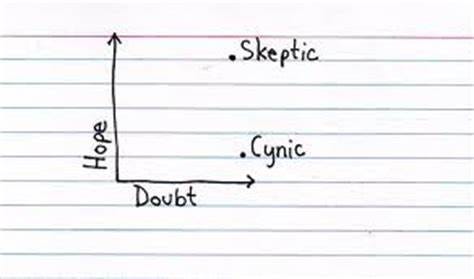

Cynic vs Skeptic

How the Karate Kid Taught Us To Read The Wall Street Journal

Face it. We are ensnared in a world of spin where true journalism has given way to opinion. Analytics has ceded to biased promotion. Taking this into account, how can we make sound investment decisions, develop strategy, and even decipher, ally from rival?

Let us look to the Ancients for guidance, Daniel-San:

A skeptic is simply someone who demands good evidence before accepting something and is willing to change their view when it conflicts with the evidence. These requirements are easy to say, but often hard to follow. Nevertheless, everyone should strive to be a skeptic.

The philosophy of skepticism goes back to the ancient Greek and Roman world. One version was Pyrrhonic, founded by Pyrrho of Elis. He gave us the Pyrrhic Victory: Win the Battle but lose the War. Pyrrhonist’s aims are psychological. It urges suspension of judgment to achieve mental tranquility. ...

What a way to end the Year!

A great article was written by our very own, Matthew Meehan (CEO, Shield Advisory Group) being featured in #Forbes today!

Check it out and let us know your thoughts.

Confectionary Espionage to Win Over Our Sweet Teeth

The story of Milton Snavely Hershey comprises the classic mathematical formula of the American dream: Adversity + Hard Work + Resilience + Giving Back to Your Community = Successful Life and Legacy. Today’s story will also include two small doses of “borrowing”.

Hershey failed twice in business before opening the Lancaster Caramel Company in 1886. Miserably. Though the third try did end up being the proverbial charm, the company came close to completely failing. Hershey was plagued with bad credit after these prior failures. A bank cashier came to the rescue by co-signing the loan himself, giving Hershey the liquidity, he needed for a batch of raw ingredients that would keep the company going.

Perspiration also needs a bit of inspiration. In 1893, Hershey had gone to the World’s Columbian Exposition in Chicago and attended a demonstration of a German chocolatier. This demo included machinery that streamlined the entire chocolate-making process. Hershey’s Eureka moment! The Hers

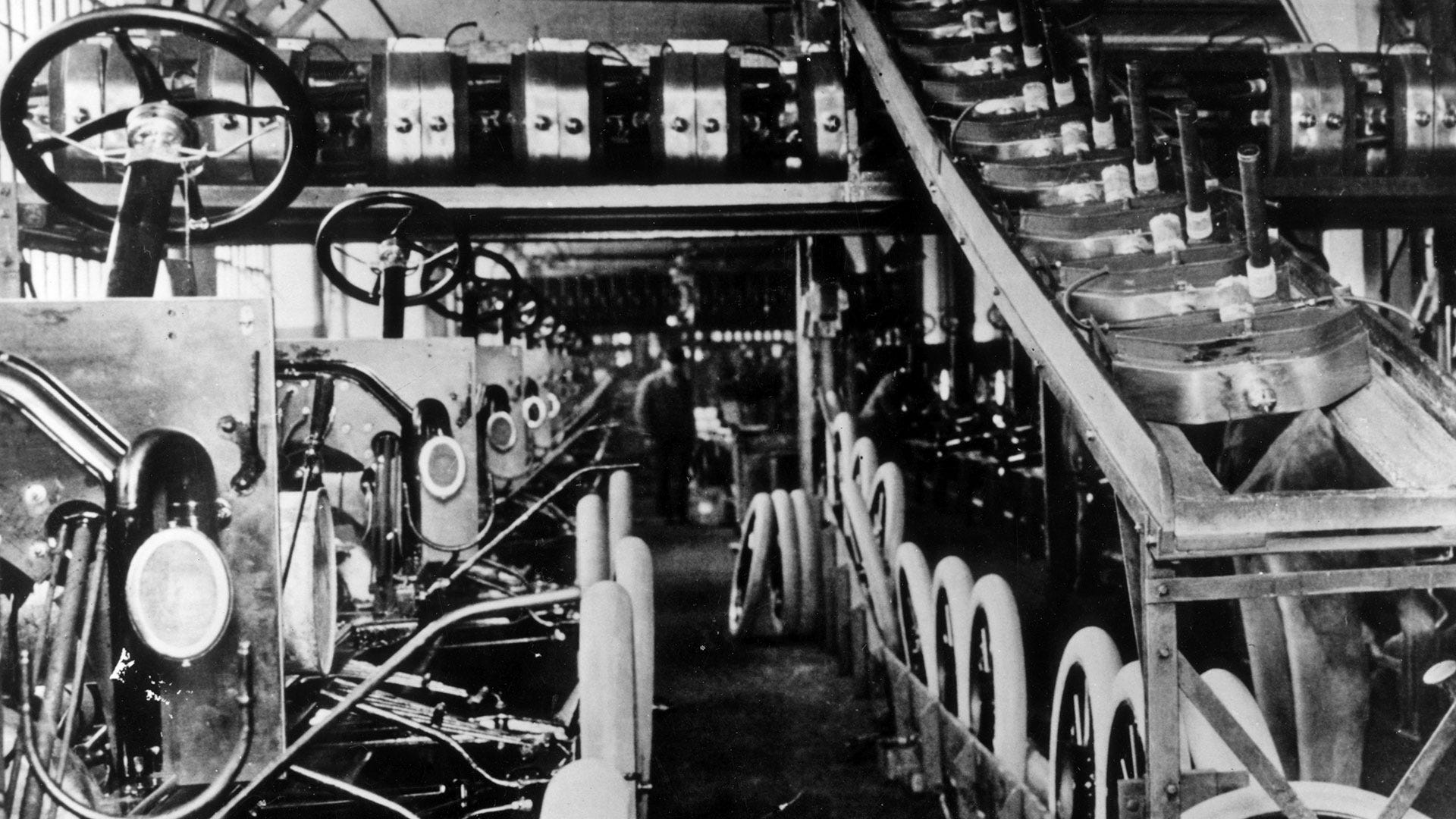

...Some Assembly Required

The Truth (Ahem!) Behind the First Assembly Line

“If I Have Seen Further, it is by Standing Upon the Shoulders of Giants” Sir Isaac Newton

The notion of organized systems is ages old with brilliant examples across history.

Adam Smith discussed the division of labor in the manufacture of pins at length in his book The Wealth of Nations published in 1776, apparently a banner year for Americans.

The Venetian Arsenal, a complex of former shipyards and armories clustered together in the city of Venice, dating back to circa 1104, operated similar to a production line. Ships moved down a canal and were fitted by the various shops they passed. At the peak of its efficiency in the early 16th century, the Arsenal employed some 16,000 people producing one ship each day, and could fit out, arm, and provision a newly built galley with standardized parts on an assembly-line basis. Although the Arsenal lasted until the early Industrial Revo...

Be Noble, Buy Local

As much as you enjoy coming home to that stack of cardboard boxes after a long day at work or whether you prefer to do your shopping alla keyboard, resist the urge. Buy local.

Supporting your local ‘Mom & Pop’ shops creates local jobs, infuses community tax coffers with dearly needed sales tax revenue and creates a sense of community critical to our social wellbeing.

Businesses may find less expensive alternatives to goods and services outside their neighborhoods. Resist this extra-locale acquisition. Over time, imports eventually become the predominant source of supply causing local businesses to suffer financially and close. This inevitably has a negative impact on the economy. Lower prices do not necessarily equate to a benefit for the ultimate consumers. Imports tend to increase the reliance of an economy on other nations. This leads to a drop in political power amongst nations. While global free trade is an ideal to be sought, sourcing as many essentials as practical locally ...